Solar Panel Depreciation Rate As Per Companies Act

These provisions are applicable from 01 04 2014 vide notification dated 27 03 2014.

Solar panel depreciation rate as per companies act. 237 e dated 31 03 2014 and notification no g s r. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Depreciation under companies act 2013. Hence one could claim 100 depreciation for a solar power project if the asset is in use for more than 180 days of the fiscal year.

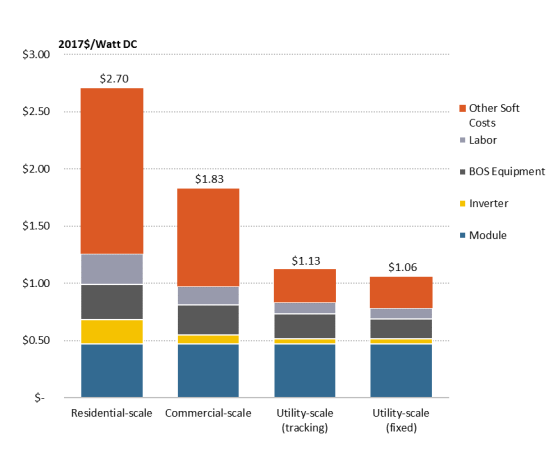

The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. In this article we have compiled depreciation rates under companies act 2013 under written down value wdv method and as per straight lime method slm. Also as per section 32 1 ii a of income tax ac 1961 an additional depreciation of 20 of actual cost can be claimed if new plant and machinery is installed for purpose of manufacturing. Solar photovoltaic panels and modules for water pumping and other applications.

26 september 2014 dear all i have a query regarding the depreciation rates as per companies act 2013 as follows. Depreciation calculator for companies act 2013. We have also compiled changes to schedule ii useful lives to compute depreciation read with section 123 of companies act 2013 made vide notification no g s r. Part a tangible assets.

Depreciation rate solar power plant per companies act income tax goods and services tax gst service tax central excise custom wealth tax foreign exchange management fema delhi value added tax dvat sez special economic zone llp limited liability partnership firm trust society company laws dtaa notifications circulars case. Under the heading plant machinery point b vi there is no specific rate mentioned for solar power plant. Depreciation rates as per the income tax act. Now the maximum rate of depreciation is 40.

1 schedule ii 2 see section 123 useful lives to compute depreciation. Depreciation rates as per i t act for most commonly used assets. Depreciation as per companies act 2013 for financial year 2014 15 and thereafter.