Solar Panel Depreciation Life Irs

You must submit a separate form 4562 for each business or activity on your return for which a form 4562 is required.

Solar panel depreciation life irs. Just return to your rental section and edit. The irs found taxpayers donald and sheila golan responsible for a tax deficiency of 150 694 and an accuracy related penalty of 30 139 after examining their 2011 income. Solar energy systems have been determined by the irs to have a useful life of five years. This would mean a 1 500 tax savings for the year for your business.

Depreciation or amortization on any asset on a corporate income tax return other than form 1120 s u s. It looks like solar panels have a 5 year life. Go through the interview and add the asset. Year 1 20 year 2 32 year 3 19 2 year 4 11 5 year 5 11 5 and year 6 5 8.

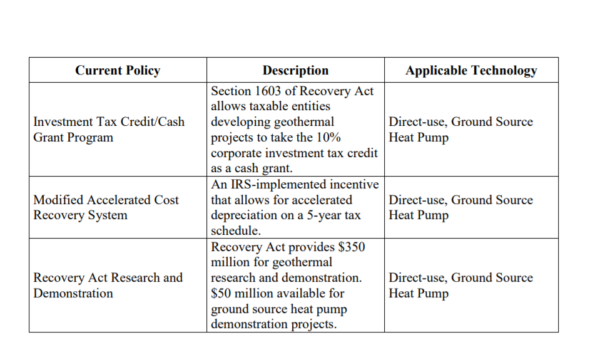

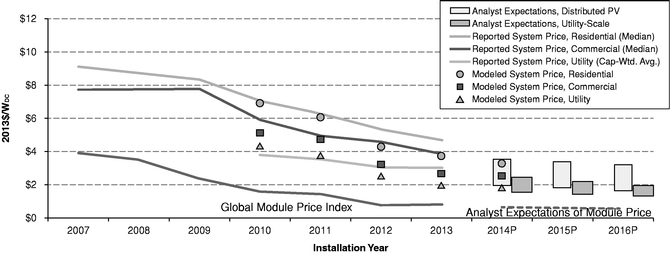

Seia supports smart tax policy that drives continued innovation in the solar industry. Normally the depreciable life of solar panels is 85 of the full solar system cost which may be depreciated roughly as follows. 1 schedule ii 2 see section 123 useful lives to compute depreciation. This approach would apply to both your federal and state tax return.

More importantly i don t know your whole situation but i feel like you are eligible for a form 3468 investment credit for your. 5 000 x 0 3 1 500. So solar panels meet all the three criteria. The tax cut and jobs act of 2017 brought with it the option for 100 bonus depreciation on solar systems which is often a great way for businesses to quickly recover costs associated.

You must have the solar project in service before january 1st 2018 to claim the 50 bonus. Macrs depreciation of solar panels. For example if the dollar amount of your solar asset s depreciation is 5 000 and your effective tax rate is 30 percent then you would execute the following equation. Depreciation on solar panels is one of the easiest ways businesses and farms looking to go solar can keep installation costs down rois high and paybacks short.

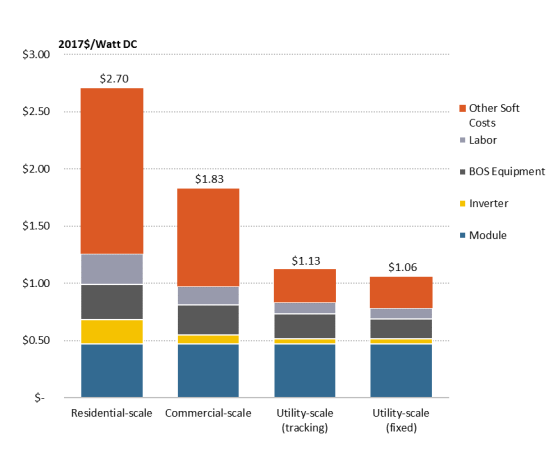

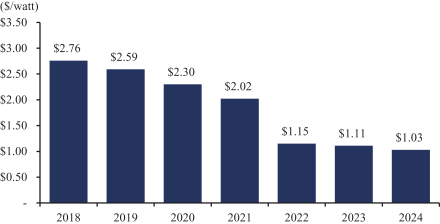

Depreciation is one aspect of the tax code that facilitates greater investment in renewable energy and ultimately lower costs for consumers. Businesses rely on policy certainty to make long term investment decisions. Depreciation under companies act 2013. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

A recent tax court case illustrated several issues common to trades or business but in the unusual context of a taxpayer who purchased solar powered electricity generating equipment installed on a third party host property. Not only do solar panels have a useful life of five years they are also used for the production of renewable energy. Income tax return for an s corporation regardless of when it was placed in service. Under 50 bonus depreciation in the first year of service companies could elect to depreciate 50 of the basis while the remaining 50 is depreciated under the normal macrs recovery period.

The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value.