Solar Panel Deduction 2019

Filing requirements for solar credits.

Solar panel deduction 2019. An average sized residential solar system about 400 square feet of solar panels costs 18 000 according to the solar energy industries association an industry group. Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit. If you buy your system in cash or with a solar loan that means you also get the tax credits rebates and srecs for the system however if you lease your system the third party owner will receive all of the solar incentives. To claim the credit you must file irs form 5695 as part of your tax return.

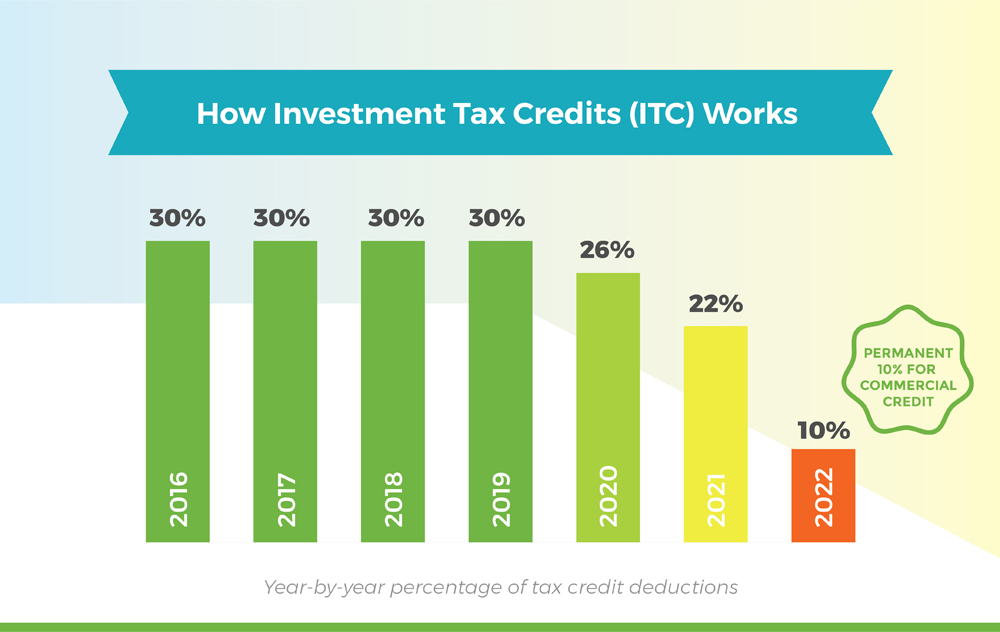

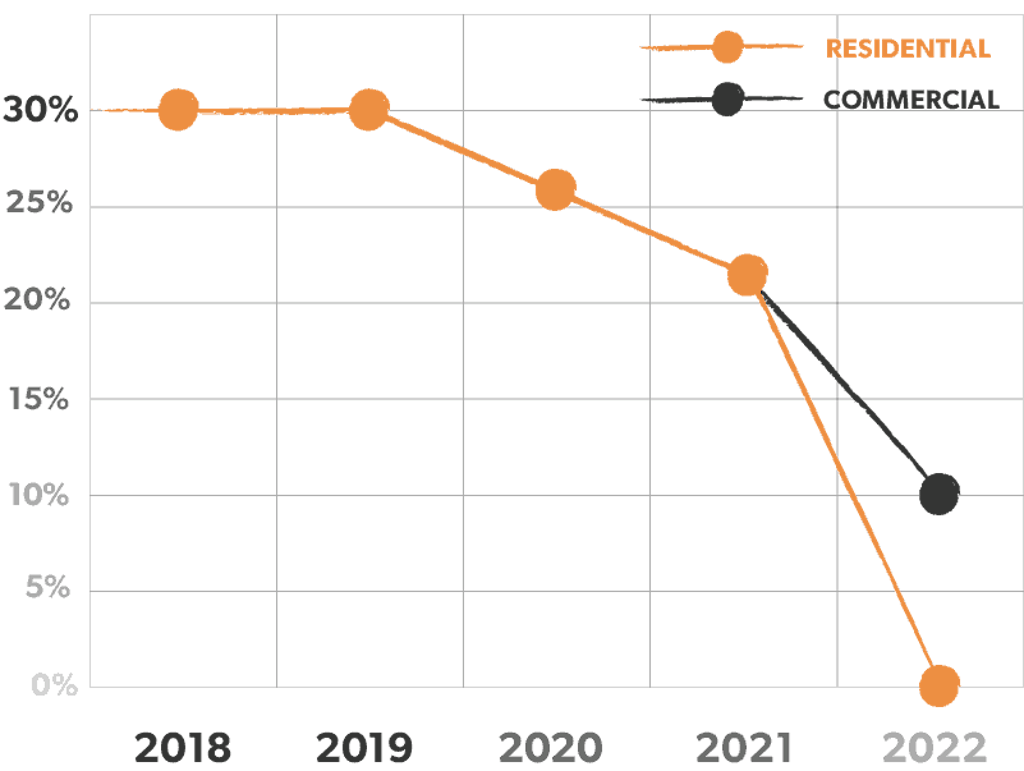

So it won t be affected if you stop itemizing your deductions. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. February 2020 have been revised to reflect the extension of the nonbusiness energy property credit to 2018 by the taxpayer certainty and disaster tax relief act of 2019. All homeowners who install a solar panel system by the end of 2019 can still claim the full 30 credit but that amount drops to 26 in 2020.

The tax break reduces. These instructions like the 2018 form 5695 rev. This is from the 2019 form when the itc was still 30. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans. At that price. You calculate the credit on the form and then enter the result on your 1040. The federal solar tax credit part of the residential renewable energy tax credit that offers 30 off your home solar installation is dropping at the end of 2019.

The federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system. All of the financial benefits listed below go to the owner of the solar panel system. Use these revised instructions with the 2018 form 5695 rev. Solar panel deduction for 2019 the federal solar tax credit residential energy credits form 5965 is a tax credit not an itemized deduction.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.