Solar Panel Credit For Business

The benefit of the solar tax credit for a taxpayer can essentially be boiled down to the benefits of installing a solar system in your own home or your business.

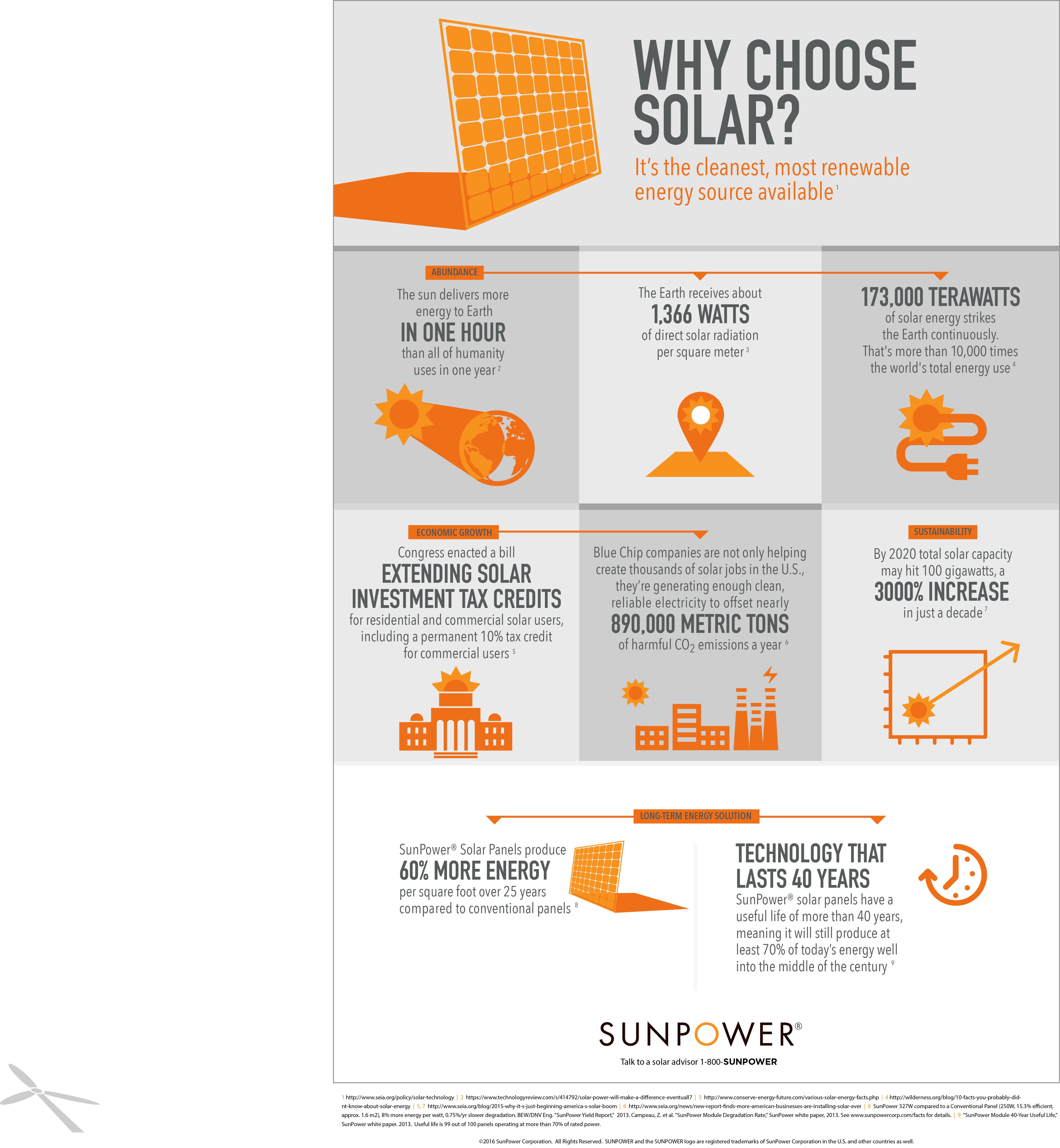

Solar panel credit for business. Homeowners solar companies and industry advocates alike were given a big christmas gift in 2015 when congress approved the 2016 federal spending bill and extended the solar panel tax credit. The very first advantage is the fact that you get to claim 30 of the installation costs with no cap to how much your system costs. The form you use to figure each. You subtract this credit directly from your tax.

For simplicity people in the solar industry just say solar tax credit or itc. The federal solar tax credit can reduce the cost to install a solar energy system by up to 30. The term solar tax credit actually refers to two separate things. For commercial solar energy under sec.

Check this post for the most up to date information for 2020. The federal solar tax credit is a huge incentive that can reduce project costs by up to 26. 1 48 9 k to be included in calculating the energy credit when adding a new roof and solar panels to the property. In addition your general business credit for the current year may be increased later by the carryback of business credits from later years.

The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans. All of the following credits with the exception of the electric vehicle credit are part of the general business credit.