Solar Panel Credit Broward County Credit

Importantly abatements are calculated before other tax exemptions like the federal tax credit for solar meaning you can claim an abatement based on.

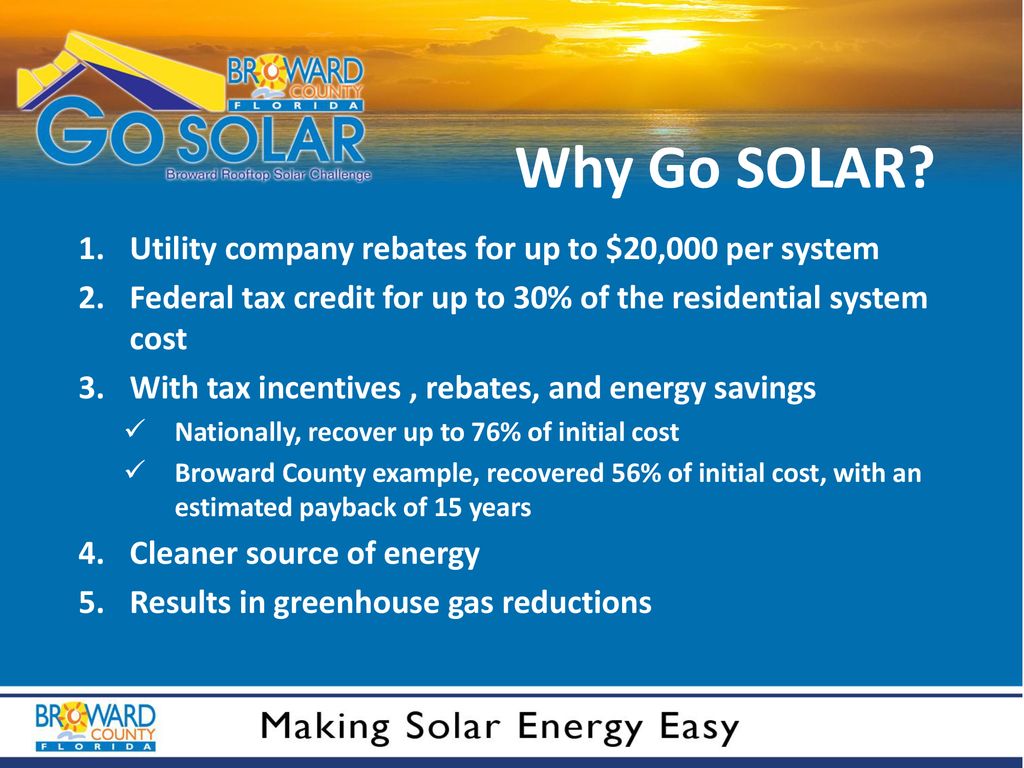

Solar panel credit broward county credit. In addition to florida s net metering policy and tax exemptions to encourage solar energy the federal government gives you another huge incentive known as the investment tax credit itc. The december 18 bill contained a 5 year solar tax credit extension which makes solar energy more affordable for all americans. The combination of excellent sun exposure the solar tax credit a great net metering policy and some of the strongest financing options in the u s. This generous rebate effectively knocks off 26 percent of the cost of your new solar energy system right off the bat as a credit on your income tax.

In addition to florida s state solar programs you ll be eligible for the federal solar tax credit if you buy your own home solar system outright. You calculate the credit on the form and then enter the result on your 1040. 25d d 1 and 2 solar water heating panels and solar electric photovoltaic panels must be installed for use in a dwelling located in the united states and used as a. 25d provides a solar tax credit to an individual taxpayer when the panels are installed for use in the taxpayer s residence.

In fact 26 of your total project costs including equipment permitting and installation can be claimed as a credit on your federal tax return. To claim the credit you must file irs form 5695 as part of your tax return. 8 that means if you purchase a 6 kilowatt system for 18 300 you ll pay. As of september 2020 the average solar panel cost in broward county fl is 2 77 w given a solar panel system size of 5 kilowatts kw an average solar installation in broward county fl ranges in cost from 11 772 to 15 928 with the average gross price for solar in broward county fl coming in at 13 850 after accounting for the 26 federal investment tax credit itc and other state and.

In new york city s solar tax abatement program you can currently take 5 of your solar panel system installation expenses and deduct that amount of money from your property taxes for 4 years. If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs. When you buy solar panels for your home you receive a 26 federal tax credit plus an additional 5 in savings on us. Allows homeowners to see an excellent return on their investment when they install residential solar panels in florida.

Florida solar power overview. The bottom line is this. Florida solar air designs solar panels systems that are in compliance with all federal reporting regulations in order to take complete advantage of this tax program. Filing requirements for solar credits.

When you install a solar power system the federal government rewards you with a tax credit for investing in solar energy.